Η ΜΑΧΗ ΤΟΥ ΜΑΡΑΘΩΝΑ ΚΑΙ ΤΟ SWAP ΤΗΣ GOLGMAN SACHS KAI TOY ΠΑΠΑΔΗΜΟΥ

A GREEK TRAGEDY

Twenty thousand battle-hardened troops and cavalry stormed off 600 Persian war ships onto the Plains of Marathon 26 miles north of Athens.

These were the shock troops of the Persian army, warriors that had built the Persian Empire into the most powerful military presence in the world of 490 BC.

The Greeks were absurdly outnumbered and some of the Greek generals hesitated going into battle, considering that a wait for reinforcements would be more prudent. But one of the generals, Miltiades, counseled attack.

The vote was split, so Miltiades went to the Polemarch of Athens (a dignitary, who, by custom, was permitted to vote with the generals). His name was Callimachus.

The Greek historian Herodotus, the “Father of History,” reports the conversation between Miltiades and Callimachus.

'With you it rests, Callimachus, either to bring Athens to slavery, or, by securing her freedom, to be remembered by all future generations.'

The Greeks attacked. They fought for their lives. They fought for their families. But most of all, they fought for their freedom.

When it was over, 6,400 Persians lay slain on the field of battle. One hundred ninety-two Greeks had died.

The Battle of Marathon was the first of the three battles of the Persian Wars between Greece and Persia – the outcome of which would alter the course of Western Civilization forever.

(According to legend, it was a man named Phidippides, who ran the 26 miles from Marathon back to Athens in three hours to tell the Athenians of the great victory. He died after delivering his message. It is the modern day marathon that memorializes his run.)

It was the victory at Marathon, and subsequent victories over the Persians, that created the sense of pride and power that ushered in the century of Athenian greatness known as The Golden Age of Greece.

During these years, Greece produced: one of the greatest statesmen in human history – Pericles; two of the most preeminent thinkers the world has ever known, Socrates and Plato, who brought whole new realms of thought and philosophy to the Western World; the Parthenon, which is still revered as one of the architectural marvels of the world; and a culture imbued with a majesty of art, literature and theater.

Greece is the birthmother of Democracy.

Today, the former Athenian nation-state, takes the spotlight as the lead in a pitiful play, which shines the spotlight of history on that nation’s economic chaos. The play is produced by the International Monetary Fund and is directed by perennial banking bad boy, Goldman Sachs. It is titled,

The Global Financial Crisis.

I know it is a harsh metaphor, but the Glory that was Greece is gone. That was then and this is now, and the country has become a broken pawn in a real life drama that is being played on the stage of international finance. Some of the cast know it is a play. Most do not. The audience – legislators, regulators, finance ministers, and nations large and small – think it is real. Which it is.

They just don’t know that it is an orchestrated reality.

Here’s the story.

DEBT AS ADDICTION ( ΤΟ ΧΡΕΟΣ ΣΑΝ ΕΞΗ)

The political descendents of those magnificent Athenians are addicts today. Like a junkie on Horse, they are driven by an insatiable lust to spend. And like all governments, they spend without regard to consequence – on war and welfare, on interest and infrastructure, on beggars and banks, on anything that will keep them in power and soothe their collective Marxian conscience.

To feed their habit, they must borrow.

The Greeks have borrowed in excess of $330 billion. This is a meaningful sum anywhere. In Greece, it is Everest.

The Greek Tragedy has been shoved off the front pages of the financial press by their Euro-cousins in Ireland as this is written. And Ireland will soon be followed by Portugal and Spain. Still, I am using Greece for illustrative purposes because this kind of financial freebasing has turned the planet into a playground for the ultimate drug dealers - the pirates in pinstripes. It is time it was exposed and hung from the yardarm of public opinion.

Here’s how that rolls out.

The Greek economy is managed like a free drug clinic in the Haight Ashbury. The government provides literally hundreds of benefits and subsidies: health care is essentially “free,” civil servants can retire with pensions in their 40s, and the government-run utilities and enterprises lose more money than a convention of Bernie Madoff investors. Greek legislators must have apprenticed with the financial masterminds in the United States Congress: the Post Office is broke, AmTrak is broke, Social Security is broke, Medicare is broke, Fannie Mae and Freddie Mac are broke, and AIG, the insurance company that the government acquired last year, has cost the taxpayers $182 billion… so far.

In 2001, Greece wanted to get into the European Union (EU). They also wanted to use the Euro as their national currency. (The countries in the EU that also use the Euro are referred to as the Eurozone. Not all European Union members use the Euro.)

But their debt was too high. Too much welfare, too many pensions, too much interest and the 12

th largest military budget in the world (taken as a percentage of GDP). Perhaps they are still fighting the Persians in their collective mind.

In any case, the EU said, “No can do.”

What to do?

Some suggested that the country cut back on spending and use their income to pay their debt down. But these people were arrested and burned at the stake as economic heretics.

The problem seemed unsolvable to the money men of Athens. How do we get into the European Union with our current debt load? How do we get in, and also keep the needle in our veins?

In the distance we hear a bugle signaling a cavalry charge. This is followed by the sound of screeching tires as a Humvee stretch-limo the size of the

Hindenburg squeals around the corner, roars up the street and pulls to a stop in front of the Presidential mansion in Athens.

The chauffeur exits the driver’s side and walks briskly around the car and opens the rear door. The first person out is a Julia Roberts look-alike in a

Valentino pantsuit. She is wearing designer shades and is carrying a Prada briefcase. She is followed by an unusually tall man wearing a midnight blue Armani suit with teal pinstripes. He is ostrich egg bald, is wearing granny glasses and has a Tumi laptop bag slung over his shoulder. He is furiously working the keys of a Blackberry while talking on a Bluetooth headset.

Goldman Sachs has arrived.

Greek treasury officials fall to their knees and weep with joy.

Saviors of nations, bankers to the over-borrowed, Goldman is there to help. Help, that is, as long as the country is willing to pledge some national assets with their tax revenues attached as collateral. They are team players, by God; give them some of your country’s tax revenue and the boys from Goldman Sachs will climb any mountain, ford any stream, follow any rainbow ‘til you find your dream (a lender with deep pockets and the ethics of a crack dealer).

What that dream looked like in real life was a package of financial sophistry that camouflaged Greece’s debt, pushed it onto the backs of their children, got them into the EU and enabled them to continue to feed their habit.

A “fix” by any other name…

In short, Goldman converted ten billion dollars of Greek debt that had been purchased with U.S. dollars and Japanese yen into debt that could be repaid in Euros. However, in creating this “currency swap”, they used a fictitious value for the Euros which lowered the reported amount of Greek debt by billions.

The structure enabled Greece to owe billions to Goldman in a currency deal without having to report it to the European Union as a loan, which is clearly what it was. Turns out using the Alice in Wonderland value for the Euro wasn’t illegal, just deceptive as hell.

Having cut the deal, Goldman’s covert loan needed to be paid. Greed never sleeps. And since the faux currency swap was not officially a loan, Goldman had to have some way to get repaid other than “loan payments”. To wit, the pirates of pinstripe go on a Hellenic treasure hunt and wind up commandeering the rights to a few of the country’s income-producing crown jewels — airport fees, the national lottery and toll road income.

Pericles, where are you?

Securing the rights to the tax revenues, they wrap the repayment into an interest rate swap. (Don’t go to sleep on me now, I’ll explain).

Greece had previously issued some bonds and had to pay the bond holders a fixed rate of interest of 4%. So, as their part of the swap, Goldman agreed to pay Greece a fixed rate of 4%. In return, the government of Greece agreed to pay Goldman a floating rate.

The exact amount Greece had to pay Goldman is not known. However, what is reported is that Goldman received a rate in excess of LIBOR (the rate set in the UK that banks charge each other for short term loans) + 6.6%.

The rate was floating, not fixed, but note that even if LIBOR was zero – 0% - (which it wasn’t) Goldman would be paying Greece 4% but would be receiving 6.6%. The absolute worst they could get, then, was an annual profit of 2.6% on a deal for $10 billion in bonds ($260,000,000).

But that’s not really enough to push those year-ending Goldman bonus babies to the Hamptons. Oh no, not by a long shot, because Goldman also picked up a fee to arrange this charade of about $300,000,000.

In summary, Goldman arranges what appears to be a currency swap for Greece, which is really a loan that doesn’t have to be reported to the EU as such.

In so doing, Greece pushes its existing debt back to the future, is accepted into the European Union, gets yet another loan, and still has access to the debt needle.

Goldman gets a fee of $300,000,000 for setting the deal up and ongoing revenue from an interest rate swap estimated at $260,000,000 a year from government owned assets.

Yeah, Baby!

Of course, the story doesn’t end there. But then you knew that, didn’t you?

ENTER THE NATIONAL BANK OF GREECE

In 2005, Goldman apparently, and we say, “apparently” as all of these figures are a matter of news reports, not official Goldman records, having received their eye-watering fee and having recouped about a billion dollars from the interest rate swap (which is what they were reportedly out-of-pocket on the deal), sold the balance of the deal to the National Bank of Greece.

At this point, Goldman is out of it; Greece has joined the European Union and it now owes the balance of the off-balance-sheet loan of about $9 billion to their homies at the National Bank of Greece.

All is well…well, that is until 2008 and the eruption of the Global Financial Crisis.

THE HELLENIC SWAP

As the planet’s financial system started to go into the DTs, the European Central Bank did what all central banks do at such times, they went to print mode. They structured a program designed to pour billions of Euros into the European banking system.

The National Bank of Greece wanted some of that cheap coin. They could borrow it from the European Central Bank (ECB) and lend it out at handsomely higher rates. Yum, yum. But to get it, they had to pledge some collateral to the ECB, collateral they didn’t have.

What they did have was the income stream from the government tax revenues that they had purchased from Goldman three years earlier. There was just one problem, the European Central Bank would not lend to them on that deal. They needed to pledge some bonds.

It’s midnight in Athens. From the roof of the headquarters office of the National Bank of Greece we see a gigantic spot light beaming an enormous image of a dollar sign into the Mediterranean sky, a la the Bat Signal.

The next morning, the Humvee is back with Julia, baldy and their Blackberries. Goldman goes into closed-door session with representatives of the National Bank of Greece and the Treasury officials of the Hellenic Republic. At this point, the Greek government owes the National Bank of Greece about seven billion dollars.

Goldman channels Houdini yet again. They create and execute what has come to be called “The Hellenic Swap.” And if you want to see some sleight of hand on the stage of international finance, watch this, because this kind of fiscal alchemy is going on 24/7 around the planet with governments large and small.

In December, 2008, Goldman arranges an interest rate swap between the Greek government and the National Bank of Greece (The Hellenic Swap).

THE HELLENIC SWAP

Under the terms of this arrangement, the Greek Government (the Hellenic Republic) is to receive fixed-interest payments from the National Bank of Greece of 4.5 % on $6.96 billion dollars.

In return, Greece agrees to pay the National Bank of Greece an interest rate of LIBOR + 6.6% on that amount of money. LIBOR was .8% at the time, making the Greece’s interest rate 7.4%. This rate could fluctuate but could never go below 6.6%.

As can be seen, the National Bank of Greece makes a profit of 2.9% on this swap (about $201,000,000 a year). Nice.

Except the National Bank of Greece doesn’t keep the swap. Not exactly.

Shortly after setting up the interest rate swap between the government and the bank, Goldman sets up an entity in London called Titlos, PLC. The name isn’t important, but what they do is. Titlos is what is called a “Special Purpose Vehicle (SPV).” That means it is a legal entity that was set up for the sole purpose of conducting a financial transaction.

Titlos issues $6.96 billion worth of notes on which interest is payable.

Titlos then trades the notes to the National Bank of Greece in exchange for their rights to the Hellenic Swap. It so happens that the notes issued by Titlos are the same amount as the balance of the loan that Greece owed the bank ($6.96 billion).

Greece now owes

Titlos the $6.96 billion and is paying the Goldman created shell the 7.4% interest while receiving a fixed rate of 4.5%.

Titlos receives money, takes an administrative fee and the 4.5% that it must pay Greece, and pays the balance to the National Bank of Greece which services the interest due on the notes.

And Shazam! The National Bank of Greece now has bonds that it can pledge to the European Central Bank so they can borrow some of that cheap money and lend it dear. In essence, Goldman has become a Central Bank creating money out of thin air.

We love you, Goldman.

(Two years later, when the country is on the verge of financial collapse, Goldman issues a statement downgrading the National Bank of Greece saying, “Greece faces both a liquidity and, potentially, a solvency problem. While we believe that, individually, Greek banks tend to be well-run, the problems they face are outside their operational control.”)

Isn’t that sweet?

THE GREEK BANKRUPTCY

Meanwhile, the Athenian addiction continued.

The country finally hit the wall about a year ago, at which point there was a real potential that the nation of Pericles was going to declare bankruptcy.

What does this mean? It means that Greece had reached the point that they could no longer pay the interest on their debt – their bonds.

Markets roiled as Greece went cap in hand to their brethren in the European Union, “Buddy, can you spare a billion?” The Eurozone countries bitched, protested and criticized, and in the end, along with help from the IMF, coughed up $146 billion.

It wasn’t altruism, mind you. No, no. This was pure self-interest. The situation in Greece had helped to drive the value of the Euro down 15% during the first six months of the year. (George Soros, the Dorian Gray of international finance, must have been orgasmic.) The bailout halted the fall.

If Greece had gone bankrupt, the Euro would have become a doormat on international currency markets and Eurozone economies would have descended into some kind of fiscal horror show.

But it wasn’t just the sky-diving currency that got them to pony up: European banks including those in France, Germany and Switzerland held over $200 billion dollar’s worth of Greek debt. Just like their good ole’ Uncle Sam, with banks at risk, Greece became “too big to fail.”

THE GREEK TRAGEDY GOES GLOBAL

The deeper problem is this: it isn’t just Greece. In what can only be described as one of the world’s more disgusting acronyms, Spain, Ireland and Portugal have now been included in the fraternity of the financially fallen, which is referred to in the financial press as the PIGS (Portugal, Ireland, Greece and Spain). Italy is often included which expands it into PIIGS. Some include Great Britain, which makes it PIIGGS. Still, a pig by any other name….

The following lead from the May 6, 2010 issue of

World Politics Review is one of countless articles exposing the fact that the deficit ridden PIIGS could bring down the economies of Europe.

With last year's swine flu scare already a distant memory, the risk of a new epidemic is spreading across Europe. This time the fears have to do not with the H1N1 virus, but with the debt contagion facing Europe's PIIGS: Portugal, Ireland, Italy, Greece and Spain. With each of these countries carrying high debt-to-GDP ratios, financial markets are growing increasingly skeptical that Greece's debt crisis will be successfully quarantined within its borders.

No surprise really when one considers that 15 of the 16 zone members have used swaps to “manage” their debt.

A UPI story of November 13, 2010 states,

“The BBC said Irish officials were holding preliminary discussions with the EU about getting assistance from the European Financial Stability Fund. Officials estimated the country would need a bailout of $82 billion to $110 billion.”

Irish officials denied that they were seeking a bailout until the EU agreed to cough up $115 billion on November 29

th so that Ireland could follow in the footsteps of their Hellenic brethren – the debt needle inserted deeply in the fiscal vein while the country goes slowly unconscious.

IMF, drug dealers to the world.

The point here is not Ireland, or Greece, for that matter.

Greece was representative of a larger problem in the PIIGGS. But the problem in the PIIGGS is representative of the entire planet – a world mired in a vast interconnected Ponzi scheme of more than a $1.1 Quadrillion dollars of derivatives, $600 trillion of which are interest rate swaps – a scheme that is so vast, even the people who built it have lost control.

American banking is not immune. U.S. banks have $216 trillion in derivatives: JPMorgan, $81 trillion, Bank of America, $38 trillion, Citibank, $29 trillion, Goldman Sachs, $39 trillion, HSBC North America, $3.4 trillion, Wells Fargo, $1.8 trillion; this according to the Office of the Controller of Currency’s quarterly report for the first quarter of 2010 and the March 30, 2009 article

Geithner’s Dirty Little Secret by William Engdahl. Historically, 60% of derivatives are interest rate swaps. Do the math.

(Note: the derivatives market consists, to large degree, of bets on other people’s bets. A swap is made [which is really a bet on which way interest rates will go, or whether a country’s bonds will be repaid, etc.] and then other people and institutions bet on which way the swap will go, and then others bet on that bet and others bet on…. In short, it’s a colossal Ponzi scheme operating as a global casino, built on hot air and greed. So, lots of people are betting a derivative will go one way and a corresponding number are betting the opposite. If all of these bets were called at the same time, many would cancel each other out. If all of the bets on bets are washed out, the actual money at risk is about 20% of the face value of the derivatives market. Still, we are talking about trillions.)

Which brings us back to what is truly driving the actions of the Fed, the International Monetary Fund and the Bank for International Settlements.

Perhaps you have noticed that the Federal Reserve (which we remind you, is owned by the major New York banks, not the U.S. government) has kept interest rates at zero for the last two years.

What happened to the banks who bet on low interest rates using interest rate swaps? They made billions in profit. Why? Because they arranged to receive fixed rates from borrowers (cities, states, universities) in exchange for floating rates. The floating rates were tied to the Federal Reserve’s Fed Funds rate, which was lowered to zero due to the “financial crisis.”

Consider the fact that the financial crisis seems to have missed JPMorgan, who made about $5 billion in profit on interest rate swaps during the first 9 months of 2008, the very heart of the crisis.

Goldman Sachs made similar profits on these swaps as did Wells Fargo, to name a few. Of course, the cities, counties and states that took the other side of these bets on the advice of investment bankers to protect their bonds, got slaughtered. But let’s not be too harsh on them. According to Goldman Sachs’ CEO, Lloyd Blankfein, following his testimony before Congress, he’s just a banker “doing God’s work.”

We love you, Lloyd.

But here’s the problem.

The majority of the more than a half quadrillion dollars in interest rate swaps are

held mainly by banks.

Stay with me here.

With rates at zero, what’s the only way they can go?

That’s right, up.

And what will happen to those banks with trillions of dollars of interest rate swaps in their portfolios when rates start to climb?

The planet is drowning in a multi-trillion dollar game of banker baccarat, whose players will suffer massive losses when rates reverse.

Will the Fed warn Goldman and JPMorgan about a coming increase in rates so that they can dump their swaps on some other drunk in the casino? Perhaps, but to whom do you sell trillions of dollars of hot air after someone has stuck a pin in the balloon?

And at this point, this isn’t entirely up to Bennie and the Jets. The U.S. Government went $1.4 trillion in debt last year and recorded a $1.3 trillion deficit this year.

Which means?

Which means that for China, Japan or the tooth fairy to buy our Treasury Bills now, rates will have to rise. China is not drinking Tim Geithner’s Kool Aid. And the U.S. government will have to raise rates at some point to entice others to buy our fiscal waste. If we don’t raise them, the market will force them up.

Not, says Ben, on my watch. The Bald One just announced he was going to buy $600 billion dollar’s worth of U.S. government debt starting immediately. Ben calls the Alice in Wonderland money injection, “Quantitative Easing.” This is the second round of quantitative easing- the first one was an unqualified disaster - so this one is now referred to as QE2.

Sounds like a Steven Spielberg-created alien robot.

Ben is nothing if not brilliant. If he takes to the presses and buys Timmy Geithner’s debt he doesn’t have to rely on his comrades in the People’s Republic of China to buy it. Rates will stay low. And the trillions of dollars of interest rate swaps - which are owned by the same people who own his bank - will be safe.

Ben could be up for a Nobel Prize.

Except that’s not what happened. Finance ministers from around world issued statements implying that Ben was smoking something. And as noted by Mike Larson, of

Money and Markets, some of the key U.S. government bond yields not only didn’t go down, they soared.

And what did our bankers, the Chinese, do? The Chinese credit rating agency, Dagong Global, downgraded the debt of the United States citing, “…the detrimental effects of the QE2 plan and the U.S.’s sizable debt load.”

Oops.

A final thought.

What if, just what if, monetary systems were based strictly on products and real estate values.

Currency would not be paper, based on government dictate, and it wouldn’t be based on gold (though a gold-based currency would be better than fiat, the price of gold can be manipulated.)

The money in circulation would represent the goods and services available to be purchased. There would be sufficient money to buy what was available to be bought. The more productive a country, the more money it would have.

You couldn’t pull a Federal Reserve prank and inflate the currency or deflate it for that matter, which is what causes roller-coastering economies.

There are details to work out: It would take an annual survey of actual GDP, and the currency in circulation would have to be adjusted annually to correspond with actual products. But think about it: a monetary system based on actual products.

Meanwhile, keep your powder dry.

John Truman Wolfe

Copyright ©2010. John Truman Wolfe. All Rights Reserved.

References:

Revealed: Goldman Sachs’ mega-deal for Greece http://www.risk.net/risk-magazine/feature/1498135/revealed-goldman-sachs-mega-deal-greece

Is Titlos PLC (Special Purpose Vehicle) The Downgrade Catalyst Trigger Which Will Destroy Greece? http://www.zerohedge.com/article/titlos-llc-special-purpose-vehicle-downgrade-catalyst-trigger-which-will-destroy-greece

Eight Financial Fault Lines Appear In The Euro Experiment!

http://www.marketoracle.co.uk/Article17332.html

Sultans of Swap – Explaining $605 Trillion of Derivatives!

http://www.safehaven.com/article/15906/sultans-of-swap-explaining-605-trillion-of-derivatives

Goldman, Greece and a Troubling Tango http://www.nickdunbar.net/?page_id=298

London firm was created to route cash by Carrick Mollenkamp

http://online.wsj.com/article/SB10001424052748703791504575079903903971986.html

Goldman Sachs Transactions with Greece http://www2.goldmansachs.com/our-firm/on-the-issues/viewpoint/viewpoint-articles/greece.html

Eurozone approves massive Greece bail-out http://news.bbc.co.uk/2/hi/8656649.stm

Ireland’s Fate Tied to Doomed Banks by Charles Forelle and David Enrich

http://online.wsj.com/article/SB10001424052748704506404575592360334457040.html

Wall Street Collects $4 Billion From Taxpayers as Swaps Backfire http://www.bloomberg.com/news/2010-11-10/wall-street-collects-4-billion-from-taxpayers-as-swaps-backfire.html

The ideas and suggestions contained in this article are not intended as a substitute for consulting with your financial adviser. Always check with your own legal, financial or investment adviser before making investment decisions.

Neither the author nor the publisher shall be liable or responsible for any loss, injury or damage allegedly arising from any information or suggestion in this article. The opinions expressed in this article represent the personalviews of the author. Past performance is no guarantee of future results and no guarantees are made – experessed or implied.

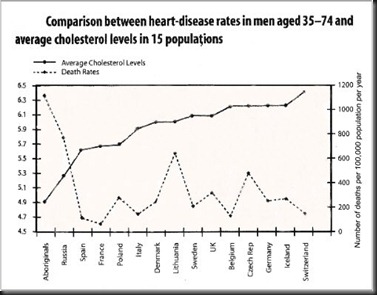

Έτσι, αγοράζετε τυρί, γάλα και γιαούρτι χαμηλά σε λιπαρά και αποφεύγετε τα κανονικά σε λιπαρά τυριά, το πλήρες γάλα και γιαούρτι, με τα οποία επί χιλιετίες οι άνθρωποι τρέφονταν. Αποφεύγετε να τρώτε αυγά και γαρίδες καθώς και άλλες τροφές πλούσιες σε χοληστερίνη, διότι πιστεύετε, ότι θα αυξήσουν τη χοληστερίνη στο αίμα σας.

Έτσι, αγοράζετε τυρί, γάλα και γιαούρτι χαμηλά σε λιπαρά και αποφεύγετε τα κανονικά σε λιπαρά τυριά, το πλήρες γάλα και γιαούρτι, με τα οποία επί χιλιετίες οι άνθρωποι τρέφονταν. Αποφεύγετε να τρώτε αυγά και γαρίδες καθώς και άλλες τροφές πλούσιες σε χοληστερίνη, διότι πιστεύετε, ότι θα αυξήσουν τη χοληστερίνη στο αίμα σας.